Start Up

|

Week 3.

|

Business Structure

Choosing model with legal and tax considerations. Understanding hierarchy, management, employees and stakeholders. Operational procedures. Financial planning, ROI’s, credit, banking, projections and dividends. Supply chain networks and maintaining a high Customer Service culture. Effective communications and liaisons. Macro and Micro environments. |

First things first.. The Economy: Exchange of Money

Review the "How the Economy Works" video gets to the heart of how the economy works.

The economy has an effect on everything. Our Jobs, our communities, and most importantly how our Businesses work.

Take a look at the video and learn about how the "Wheels of Industry" turn. Money is used, transferred and returned in fascinating ways.

Keep learning about what's going on in the economy to help your business succeed.

The economy has an effect on everything. Our Jobs, our communities, and most importantly how our Businesses work.

Take a look at the video and learn about how the "Wheels of Industry" turn. Money is used, transferred and returned in fascinating ways.

Keep learning about what's going on in the economy to help your business succeed.

First Base. Choosing the Right Business Structure

Business Structure.

|

|

What's the right Business structure for my business?

When starting your business you will be thinking about if you are "going it alone" or with a partner? Perhaps you have investors and shareholders who will help and work in the business or just be part owners but involved. Tax considerations are important in choosing the right set up. Remember you can change as the business grows or has ownership changes. Video 3:41 mins |

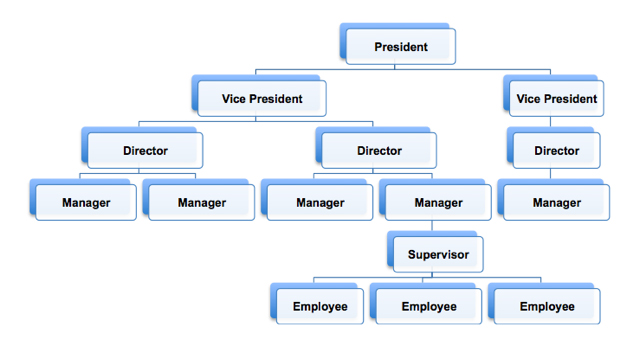

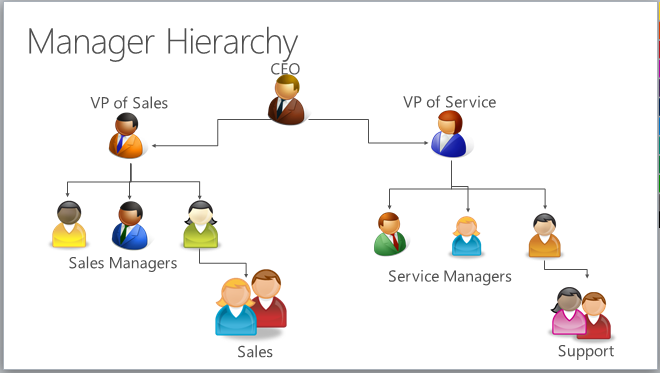

Management and Employee Structure

Also known as Employee Hierarchy. This is how the Senior Managers from the CEO to Sales and support staff all report and work.

together. It can also show the employee who their supervisor reports to and all the way to the top of the company.

A good structure will let everyone in the company work like a team and help the business to function smoothly, which makes for a great place to work. Employees can use this to try to get a promotion. A lot of people start as employees and work their way up to CEO.

together. It can also show the employee who their supervisor reports to and all the way to the top of the company.

A good structure will let everyone in the company work like a team and help the business to function smoothly, which makes for a great place to work. Employees can use this to try to get a promotion. A lot of people start as employees and work their way up to CEO.

|

Financial Planning

|

Financial Statements

|

Your financial statements should show both a long- and short-term vision for your business. In business plans, three-year and five-year projections are considered long term, and your plan will be expected to cover at least three years. Your projections should be neither overly optimistic best-case scenarios, nor overly cautious worst-case scenarios, but realistic in-between projections that you can supportThe three basic financial statements are the

(1) Balance sheet, which shows firm's assets, liabilities, and net worth on a stated date; (2) Income statement (also called profit & loss account), which shows how the net income of the firm is arrived at over a stated period, and (3) Cash flow statement, which shows the inflows and outflows of cash caused by the firm's activities during a stated period. Also called business financials. |

In the end, making your business succeed is your utmost concern,

and sound financial planning can increase the chances of that happening.

and sound financial planning can increase the chances of that happening.

Doing the Math is the Most Important Exercise in Business

Quiz Time- Week 3

Site powered by 775Marketing